Listen to this article instead

Millennials redefined the expectations for what digital payments and omnichannel commerce look like. Gen Zers are the first true digital natives and the trendsetters driving the evolution of tomorrow’s payment solutions. Baby boomers are the cash and card generation, the most cautious with new payments tech and the generation that merchants can’t afford to forget about as we move into a new digital age.

But what about Generation X?

Gen X encompasses people born between 1965 and 1980. It is often described as the forgotten generation, a moniker that holds true when it comes to the wider discourse around digital payments and the industry’s evolution. Millennials and Gen Z are the archetype of the future-forward, tech-savvy consumer, while baby boomers represent users strongly tied to legacy systems. Because Gen X doesn’t fit neatly into any of these categories, it doesn’t get talked about much at all.

But that’s a big mistake. As we’ve seen from our research, including our newest survey on consumer payment preferences in 2025, Gen X is actually a very forward-thinking generation that resembles Millennials and Gen Z in its openness to new payments tech and attitude around good checkout experiences. Like younger consumers, they demand flexible choices from merchants, and they expect to be able to serve themselves. They also embrace newer payment options like digital wallets and even AI-powered experiences at a surprisingly high rate.

In this article, we’ll give Gen Xers the spotlight they deserve by looking at some of the ways they stood out in our most recent survey of 1,000 U.S. consumers.

What Does Gen X Want From Payments?

Gen X Wants Faster, More Convenient, Tech-Forward Payment Options

Generation X is the demographic that grew up during the widespread transformation from analog to digital. But, despite that technological journey, all of Gen X reached adulthood before mass internet access. That often results in them being grouped with baby boomers on one side of an imaginary line while Millennials and Gen Z are grouped on the other.

But, as you’ll see below, when it comes to payments technology, Gen X should probably be considered much more like Millennials than boomers. Based on the responses to our newest survey, Gen X is:

- Highly open to new payment methods like digital wallets

- Concerned with options and choices in their payment experiences

- Likely to choose self-serve options like self-checkout lanes and kiosks

- Open to cutting-edge technology like AI-driven payments and wearables

Gen X Is Eager for the Rise of Digital Wallets

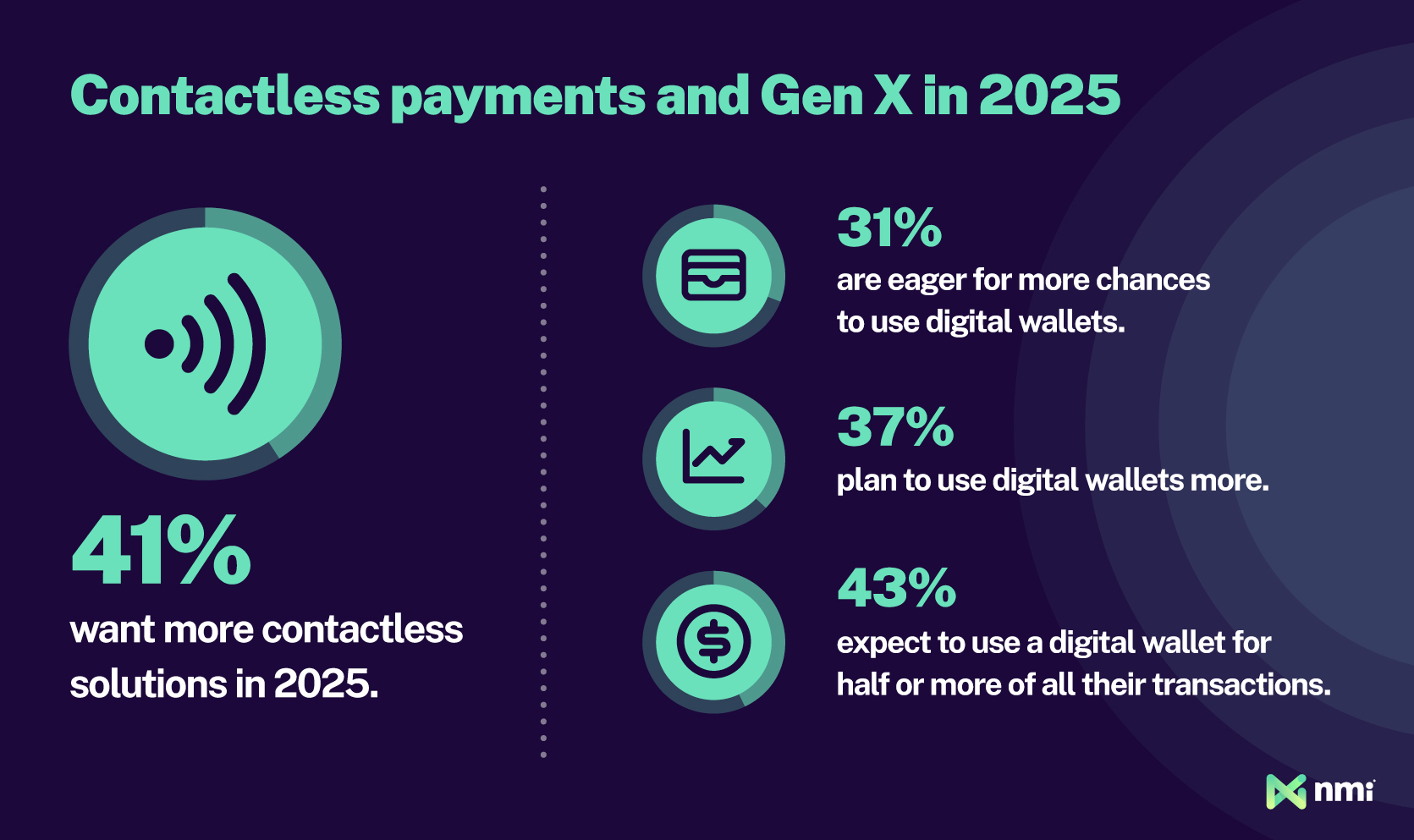

41 percent of Gen X respondents told us they want more contactless solutions in 2025 — nearly identical to Gen Z (43%) and far higher than baby boomers (26%). What is more surprising is that it turns out 31% of Gen Xers are eager for more opportunities to use digital wallets, 37% expect to use them more in 2025, and 43% said they expect to use a digital wallet for half or more of all their transactions in the year ahead. That’s almost double the 22% of baby boomers expecting to use digital wallets at the same rate.

Gen Xers Are Independent Payers and Want More Self-Service Options

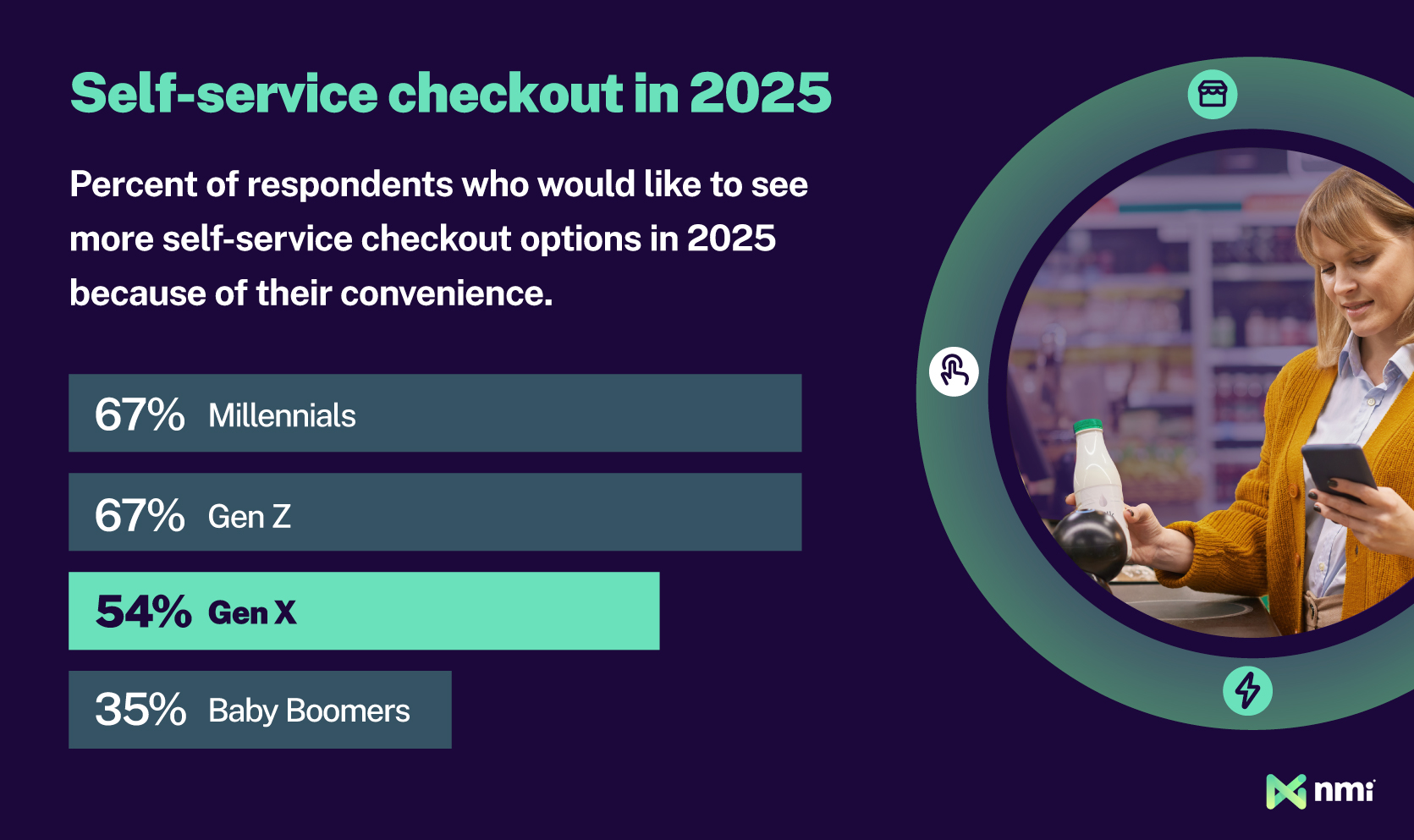

Gen X consumers are just as likely to head for the self-checkout lane as they are to line up at a cashier. 54 percent of Gen X respondents told us they’d like to see more self-service checkout options in 2025 thanks to their convenience. That falls well short of Millennials and Gen Z (67% each), but it’s a clear departure from the preferences of baby boomers, who overwhelmingly prefer to have a human check them out.

Gen X Expects Merchants To Offer Flexible Choice in Payments

45 percent of Gen X respondents told us flexible payment options are very important to them and could be a deciding factor in whether or not they choose to shop with a merchant. That tracks within Gen Z (49%) and dwarfs baby boomers, just over a quarter of whom cite flexible payments as a high priority. As it turns out, offering a variety of payment options — including digital wallets; mobile ordering; peer-to-peer (P2P) payments; and buy now, pay later (BNPL) — creates a better shopping experience for a much larger portion of consumers than many merchants previously thought.

Gen X Is Just As Ready for AI in Payments As Younger Consumers

When asked if they’d support AI-driven payment experiences, 30% of Gen X said yes, as long as it makes the checkout experience more seamless and saves time. That’s right in line with Millennials (31%) and Gen Z (33%). By comparison, only 11% of baby boomers felt the same. And only a quarter of Gen X said they wanted no AI-driven payments at all, compared with 42% of boomers. Interestingly, Gen X respondents were 38% less likely than Millennials or Gen Z to cite transparency of use as a prerequisite for supporting AI-powered payments.

Gen Xers Are Far More Likely To Use Wearables or IoT Payments Than Boomers

The Internet-of-Things (IoT) enables devices and gadgets of all types to connect and communicate via wifi or mobile signals. Now, everything from our watches and home assistants (like Alexa) to our refrigerators can connect to the internet, and they are increasingly being used to make payments. While IoT and wearable payments are just in their infancy, Gen X (17%) is already almost six times more likely to use them than baby boomers (3%). It’s still a small percentage overall, but a further 18% of Gen X respondents said they’d start using wearables or IoT payments in 2025.

What Gen X’s Payment Preferences Mean for Merchants and Providers

In many ways, the preferences of Gen X fall between baby boomers and the two younger generations of adult consumers. That makes it easy to overlook their importance — even though they are still customers with money to spend and an interest in better, faster, more convenient ways to pay.

The data shows that Gen X is a highly tech-forward generation that’s seeking many of the same solutions and experiences as Millennials and Generation Z. For merchants and payment providers, that means modernizing systems, reducing friction in omnichannel shopping and creating fast, convenient checkout experiences are more important than ever. Thankfully, with the right partner, offering the tech-forward payment experiences Gen X expects can be easy.

NMI offers a complete suite of turnkey, modular payment systems designed to help you create the faster, more convenient digital payment experiences that Millennials, Gen Z, and Gen X all demand. To find out more, reach out to a member of our team today.

Don’t just turn on payments, transform the way you do business

- Generate New Revenue By adding or expanding payment offerings to your solution, you can start earning higher monthly and transaction-based recurring revenue.

- Offer the Power of Choice Allow merchants to choose from 125+ shopping cart integrations and 200+ processor options to streamline their onboarding.

- Seamless White Labeling Make the platform an extension of your brand by adding your logo, colors and customizing your URL.