Listen to this article instead

From gateways, fintechs and banks to ISOs (independent sales organizations), PayFacs (payment facilitators) and SaaS (software-as-a-service) providers, a lot of people are involved in the payment process.

If you’re reselling payment services or gateway software on behalf of a large payment provider, their logo probably appears on almost everything. Even though you are the first (and potentially only) point of contact for your merchants, it can be easy for big-name providers to overshadow partners like yourself.

That’s where white labeling comes in.

White-label payment services put your brand front and center. The merchant experience doesn’t change, but instead of seeing your payment provider’s name and logo, they’ll see your branding from start to finish. It’s a simple change, but it will allow you to showcase your company while building stronger, stickier relationships with your merchants.

So, what are white-label payment solutions? What is a white-label payment gateway? How does white labeling benefit your business? And how can it draw more eyes to your brand?

What Is White Labeling?

White labeling is the process of placing your own branding on a product or service provided by another company. It lets you offer something to your end customers without having to manufacture or develop it yourself. White labeling is common in a variety of industries, including cosmetics, brewing, mobile phones and software.

Another term you may have heard is “private labeling.” While similar to white labeling, there is a key difference. White-labeled products are manufactured and sold to multiple customers who each rebrand them as their own. Private-label providers, on the other hand, manufacture unique products for each of their customers.

For example, Nike uses private-label manufacturing; third parties make products with the Nike logo, and only Nike can access the designs. In a white-labeling arrangement, the access is not exclusive, and other companies can also put their logos on the same clothes and accessories.

In finance, the example you’re probably most familiar with is department store credit cards. Stores like Target, Walmart and Macy’s can’t issue their own cards, so they put their logos on cards provided by big banks. The end customer may never know which bank issued their card — just that it came from Target and carries the brand’s logo.

Payment processing probably isn’t an area many people think of as a big opportunity for branding. In reality, white labeling is a very important part of offering payment services to merchants — and one far too few companies take advantage of.

How White Labeling Benefits Your Business

Whether you’re reselling payment services directly to merchants, or embedding payment solutions into your software, white labeling can improve branding, trust and customer experience. Choosing a payments provider that enables you to white label your services will allow you to access added value, strengthen your positioning in the market and maximize the return on your investment.

White Labeling Puts Your Brand Front and Center

Why highlight another company’s brand when you could showcase your own?

Just as it does in consumer goods, branding matters in payments. The more often your merchants see your brand, the more they’ll remember it. That’s important in a space as competitive as payments, where there’s no shortage of rivals trying to steal that mind share.

Featuring your own brand emphasizes the importance of your role as a partner, especially if you’re selling merchants more than just payment processing. If your merchants see someone else’s brand, it sends the message that you’re just a middleman, which makes you replaceable. But if a merchant constantly sees your brand whenever they deal with payments, they’ll feel like you’re essential to their success.

Anywhere you can claim a brand impression, you should, and white labeling makes that possible.

White Labeling Lends You Expert Status

Another area white labeling can benefit your business is customer service. When your merchants inevitably have issues or questions, they’ll reach out for support. If you have a white-labeled payment platform with built-in support tools, that process will appear to be running through your company, even if the ticket was sent to your payments partner.

Having all support run through you and carry your branding establishes you as an expert in the merchant’s eyes. That way, you get full credit for successful resolutions, even if you have to escalate to your partner for help. That not only improves the experience but also helps establish trust and makes you a more attractive service provider to new merchants.

White Labeling Saves You Money

One of the biggest reasons white labeling is popular across so many industries is that it saves companies the costs and headaches of developing solutions themselves. White-labeled payments give you access to all the services and infrastructure you need to offer your own set of branded merchant solutions, and you don’t have to worry about any of the high costs of developing technology, meeting compliance or going through expensive registrations yourself.

What is a White Label Payment Gateway?

Payment gateways play an essential role in processing payments. Here’s how gateways work:

1. When you swipe your card or make an online purchase, a payment gateway takes that card data and securely sends it to a payment processor for authorization

2. Next, the transaction information is submitted to one of the credit card networks and routed to the cardholder’s issuing bank, where the transaction is either approved or declined

3. Finally, the approval (or denial) is sent back to the payment gateway, where it receives the response and notifies the merchant

Essentially, a payment gateway works behind the scenes to orchestrate transactions. Nearly everyone uses a gateway when making a card or online payment — whether they realize it or not.

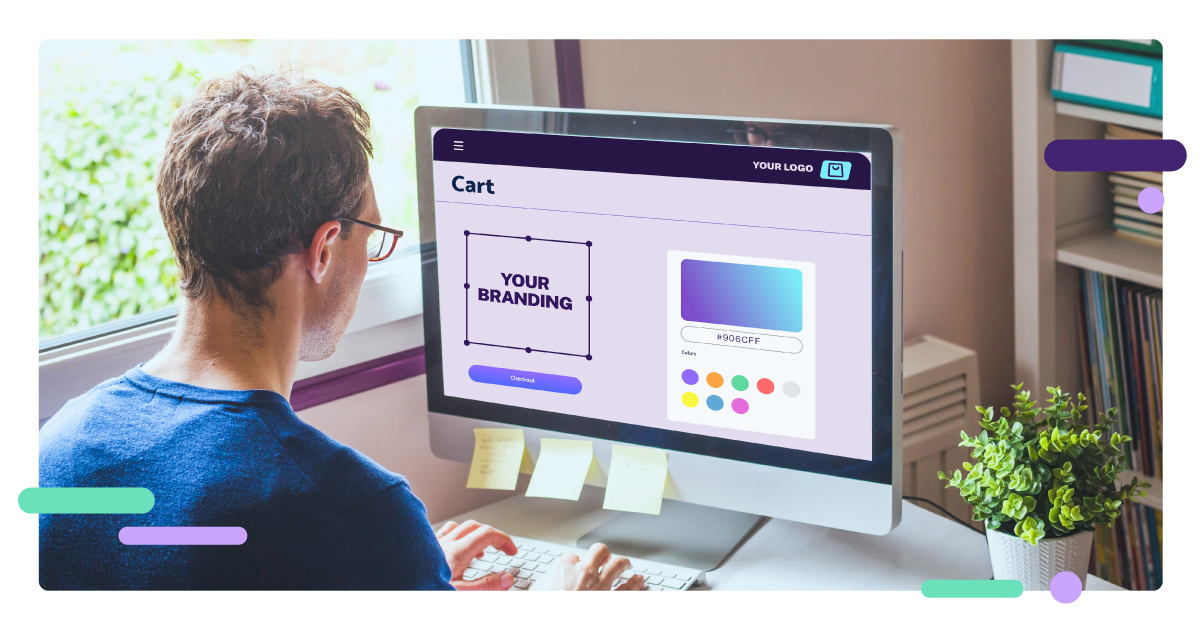

White-label payment gateways work exactly like branded ones do, with one key difference: they let you use your own branding. Partners using white labeled gateways can use their own company logo and customize the look and feel to match their brand.

Providers like these allow payment professionals and SaaS providers to enjoy all the benefits of being a gateway provider or embedding payments without the hassle of developing an in-house solution or dealing with the technical, operational or regulatory complexity of being a financial services provider — a win-win for everyone.

NMI Works Behind the Scenes to Make Your Brand Shine

“Pay no attention to that man behind the curtain.” — The Wizard of Oz

By providing a white-label service, you can create your own value and become a more active part of the revenue stream. You can also build and market your own brand rather than showcasing someone else’s.

NMI is a full-service payments provider that makes it fast and easy to offer world-class merchant services. Whether you’re an independent sales organization, payment facilitator or software developer, we offer turnkey access to the payment processing and value-added services your merchants need.

Unlike many of our competitors, our goal is to provide the infrastructure that powers our partners, so that your brand can take center stage. That’s why we offer our partners extensive white-labeling opportunities.

Make Our Payment Gateway Your Own

NMI offers one of the industry’s most popular white-label payment gateways. You’ve likely used it before without even realizing it because we make it easy to replace our branding with your own. With NMI’s gateway, you can quickly and easily redesign the logo, color scheme, fonts, login portal, and even the URL to make it look like you built everything yourself. You get all the benefits of selling your merchants a world-class, “in-house” gateway with none of the development or maintenance costs.

White Label the Complete Payments Experience

For SaaS companies looking to enter the payments game, NMI offers a one-stop embedded payments platform that enables you to recruit, register and serve merchants within a self-branded software environment. SaaS developers can offer business users an end-to-end payments experience and tap into processing fees as a new source of revenue without becoming an actual payments company. Because NMI handles all the infrastructure in the background, the software vendor’s brand always comes first.

Offer Your Merchants a White Labeled Support Portal

Merchant Relationship Management and Merchant Central are NMI’s merchant and portfolio management tools. Among the many features designed specifically to streamline the day-to-day tasks of payment companies, our relationship management suite includes a fully white-labeled merchant support portal.

Whenever merchants need assistance, they can easily submit requests online or monitor ongoing tickets through the portal. From initial submission to final resolution, the portal and the entire support experience feature your brand. This establishes you as the expert and an invaluable partner in the merchant’s payments journey.

If you’re ready to start putting your brand in front of your merchants, NMI is here to help. To find out more about how we can elevate your branding through white-labeled payments, reach out to a member of our team today.

Don’t just turn on payments, transform the way you do business

- Generate New Revenue By adding or expanding payment offerings to your solution, you can start earning higher monthly and transaction-based recurring revenue.

- Offer the Power of Choice Allow merchants to choose from 125+ shopping cart integrations and 200+ processor options to streamline their onboarding.

- Seamless White Labeling Make the platform an extension of your brand by adding your logo, colors and customizing your URL.